LME Metal Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

The Electric bike materials purchase indicators are like below:

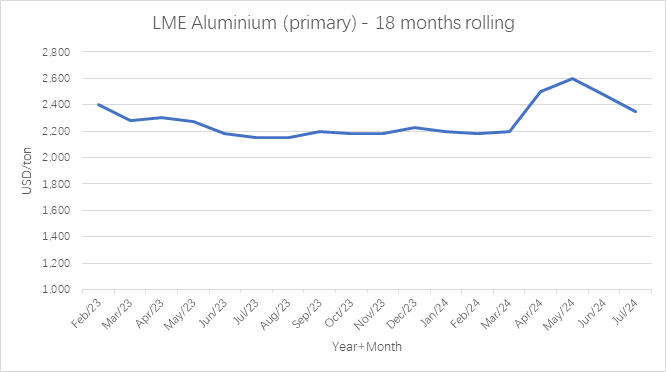

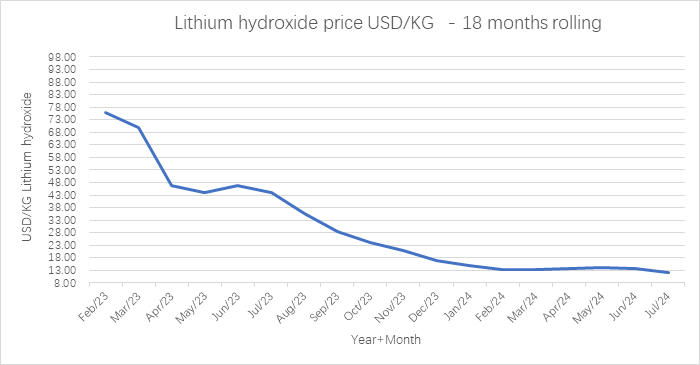

Moving commodities in July: Aluminium -5.2%, Nickel -6.3%, Lithium Hydroxide -11.8% and plastics in general (LLDPE (foil), PVC (foil), PC (clear bright) on average -7.4%). Crude oil (-10.8%) and rubber (-6.9%) dropped as well. Other materials moved within narrow ranges and the same applied to main currency pairs. Container shipping rates continued to rise from already elevated levels, Shanghai – EU+9.8% and China-EU +27%.

LME Metal Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

Original: www.lme.com

LME metals in 12 months: (USD/Ton)

| Indicator | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 |

| Steel LME Far East 3 months | 375 | 380 | 370 | 400 | 415 | 410 | 405 | 385 | 385 | 385 | 385 | 390 |

| Aluminium LME 3 months | 2,150 | 2,200 | 2,180 | 2,180 | 2,230 | 2,200 | 2,180 | 2,200 | 2,500 | 2,600 | 2,480 | 2,350 |

| Aluminium China local | 18,600 | 19,170 | 19,000 | 18,800 | 18,920 | 18,900 | 18,800 | 19,160 | 20,000 | 21,000 | 21,000 | 20,000 |

| Nickel | 20,500 | 19,500 | 18,290 | 16,500 | 16,400 | 16,100 | 16,200 | 17,500 | 18,600 | 19,800 | 17,500 | 16,400 |

| Copper | 8,380 | 8,300 | 7,950 | 8,250 | 8,450 | 8,350 | 8,350 | 8,730 | 9,400 | 10,100 | 9,600 | 9,400 |

| Cobalt (3 months buyer) | 32,500 | 32,500 | 32,500 | 32,500 | 30,000 | 28,200 | 27,900 | 27,780 | 27,600 | 26,900 | 26,300 | 25,900 |

| Lithium Hydroxide | 35500 | 28500 | 24000 | 21000 | 17000 | 15000 | 13250 | 13270 | 13700 | 14300 | 13600 | 12000 |

Steel: prices hardly moved (from USD 385/ton to USD 390/ton in July, and to ~USD 371/ton as of today), as news on continued demand weakness persisted in China:

- China mandated new (higher) material quality standards starting in September, driving mills and traders to flood the market with old stockpiles.

- China’s economy grew less than expected in Q2, and home prices slumped the most in nine years. The data reduced the global demand and Chinese economic output.

Aluminium: price dropped from USD 2,480/ton to USD 2,350/ton in July (-5.2%, ~USD 2,200/ton as of today), hovering near their lowest in five months.

- Aluminum output in China rose by 6.2% y-o-y in June to 3.76 million tons, the highest since November 2014.

- China economic data pointed at continued depressed domestic demand. Manufacturing PMI pointed to a third straight decline in July.

- Chinese factories struggle offset the lower domestic demand with exports.

Aluminium local prices in China decreased from CNY 21,000/ton to CNY 20,000/ton in July (-4.8%, ~CNY 18,750/ton as of today).

Nickel: price dropped from USD 17.5K/ton to USD 16.4K/ton in July (-6.3%, today USD 16K/ton).

- Rapid expansion of Indonesia’s nickel industry has driven the world market to oversupply.

- A temporary rise earlier this year was driven by geopolitical tensions and sanctions is now unwinding.

- Global nickel inventory forecasts predict a four-year high in 2024.

- As a result of lower prices, BHP Group Ltd. has stopped 2 major nickel mining projects in Western Australia.

Cobalt: price decreased slightly from USD 26.3K/ton to USD 25.9k/ton in July (-1.5%, ~USD 25.6K/ton today).

Lithium Hydroxide: price declined from USD 13.6/kg to USD 12/kg in July (-11.8%, ~USD 11.3/kg today), the lowest in over three years.

- Lithium miners and producers continued to expand capacity and seek new reserves (expected output growth is close to 50% this year).

- Chile announced to double their output over the next decade.

- The EU charges 38% and USA charges 100% import tax on Chinese EV, causing a 15% export drop in June.

Leave a Reply

Want to join the discussion?Feel free to contribute!