LME Metal February 2025 Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

LME Metal February 2025 Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

The Electric bike materials February 2025 purchase indicators are like below:

Moving commodities in July: steel and Copper rose by 4.3% and 3.9% respectively, cobalt deceased by 11.8%

LME Metal Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

Original: www.lme.com

LME metals in 12 months: ( Li USD/kg, others USD/ton)

| Metal Materials | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 | Sep-24 | Oct-24 | Nov-24 | Dec-24 | Jan-25 | Feb-25 |

| Steel LME Far East 3 months | 385 | 385 | 385 | 385 | 390 | 365 | 375 | 385 | 360 | 350 | 350 | 365 |

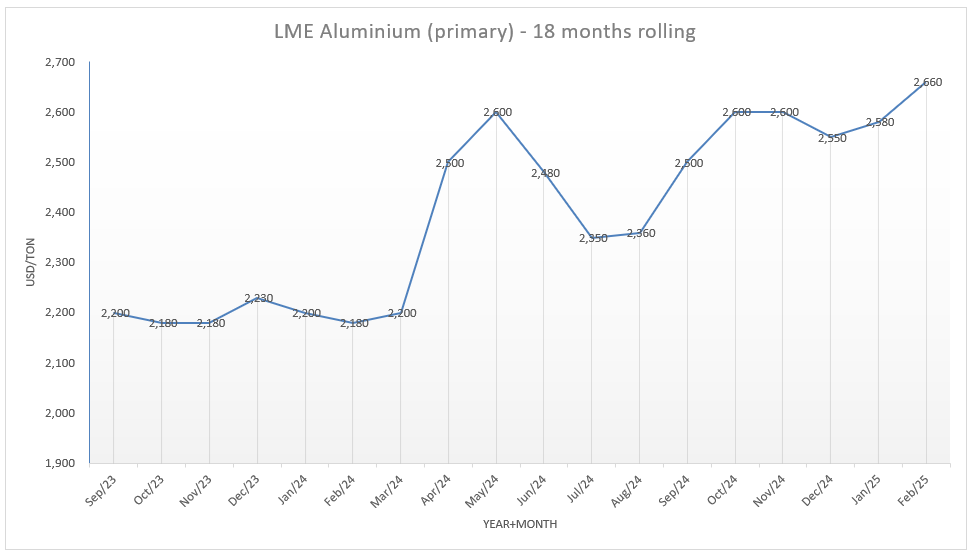

| Aluminium LME 3 months | 2,200 | 2,500 | 2,600 | 2,480 | 2,350 | 2,360 | 2,500 | 2,600 | 2,600 | 2,550 | 2,580 | 2,660 |

| Aluminium China local | 19,160 | 20,000 | 21,000 | 21,000 | 20,000 | 19,600 | 20,400 | 20,900 | 20,600 | 20,600 | 20,200 | 20,550 |

| Nickel | 17,500 | 18,600 | 19,800 | 17,500 | 16,400 | 16,300 | 16,300 | 17,000 | 15,700 | 15,500 | 15,400 | 15,400 |

| Copper | 8,730 | 9,400 | 10,100 | 9,600 | 9,400 | 9,000 | 9,300 | 9,500 | 9,000 | 8,950 | 8,950 | 9,300 |

| Cobalt (3 months buyer) | 27,780 | 27,600 | 26,900 | 26,300 | 25,900 | 24,500 | 23,600 | 23,800 | 23,800 | 23,800 | 23,800 | 21,000 |

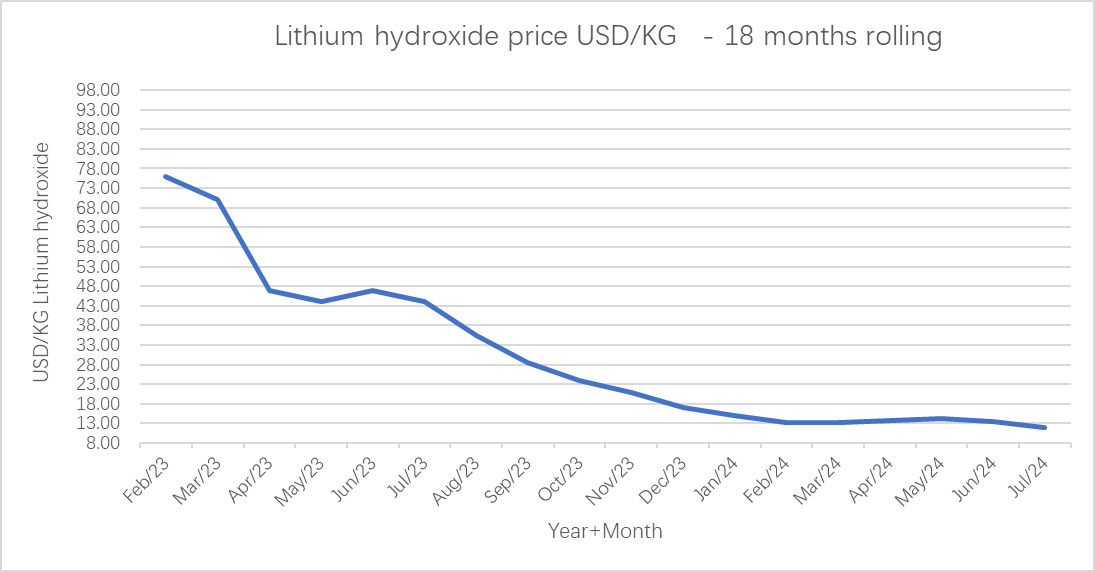

| Lithium Hydroxide | 13.27 | 13.70 | 14.30 | 13.60 | 12.00 | 11.10 | 10.00 | 9.60 | 8.90 | 9.45 | 9.47 | 9.30 |

Steel: prices rose from USD 350/ton to USD 365/ton in February (4.3%, ~USD 376/ton as of today).

- Beijing is expected to shrink capacity by 50 million tons this year to counter overcapacity, caused by lower construction demand from China’s property crisis and lower export ability.

- Vietnam put anti-dumping tariffs Chinese steel and South Korea, Brazil and Chile have pledged comparable measures (China exported a record-high 117 million tons in 2024, a 25% increase).

- In the meantime, the China domestic PMI is showing recovery (52.7 in February), contributing to cautious optimism.

Aluminium: price increased from USD 2,580/ton to USD 2,660/ton in February (+3.1%, ~USD 2,690/ton as of today).

- Renewed threats from the European Commission to put additional sanctions on Russian aluminium.

- Signals from the US to relax sanctions on Russia, easing growing concerns of low supply and lifting Rusal’s export outlook.

- Reduced Chinese aluminium exports after ending export stimulus measures, taking away a substantial price pressuring factor.

- On the demand side, a series of economic stimulus in China raises expectation of higher demand.

Local aluminium prices in China rose from CNY 20,200/ton to CNY 20,550/ton in February (+1.7%, ~CNY 20,770/ton as of today).

Aluminium: price increased from USD 2,580/ton to USD 2,660/ton in February (+3.1%, ~USD 2,690/ton as of today).

- Renewed threats from the European Commission to put additional sanctions on Russian aluminium.

- Signals from the US to relax sanctions on Russia, easing growing concerns of low supply and lifting Rusal’s export outlook.

- Reduced Chinese aluminium exports after ending export stimulus measures, taking away a substantial price pressuring factor.

- On the demand side, a series of economic stimulus in China raises expectation of higher demand.

Local aluminium prices in China rose from CNY 20,200/ton to CNY 20,550/ton in February (+1.7%, ~CNY 20,770/ton as of today).

Nickel: prices remained stable at USD 15.4K/ton in February (0%, ~today USD 16.1K/ton).

- Indonesia considers reducing nickel mining quotas by 120 million tons in 2025, enough to reduce global supply by 35%. As this reduction hardly sparked a price reaction, it indicates that the market is still oversupplied and inventory at LME warehouses still remain 100% higher than one year ago (nearly 200 thousand tons finished product).

- Rising Chinese PMIs in China in February moved market from a bearish to a slightly positive sentiment.

Cobalt: prices declined from USD 23.8K/ton to USD 21K/ton in February, but reversed to USD 25.5k/ton in March (-11.8%, ~USD 25.5K/ton today).

Lithium Hydroxide: price decreased from USD 9.47/kg to USD 9.3/kg in February (-1.8%. today’s price is ~USD 9.09/kg), amid persistent pressure from an oversupplied market.

- EV sales in China rose by 17% annually in January and accounted for over 42% of total sales as Beijing rolled new fiscal benefits for NEV purchases (but battery inventories still remain high).

- Lithium miners don’t want to close operations to retain market share and business relationships with governments and battery producers.

- • Rio Tinto aims to enter the lithium market after buying US-based Arcadium Lithium for $6.7 billion.

Leave a Reply

Want to join the discussion?Feel free to contribute!